Arken

AI co-pilot

2025

Situation

Arken is an AI co-pilot for a Bank Investment Department, designed to streamline the daily work of Relationship Managers (RMs) by consolidating internal data and external insights into one client-focused tool. The project was initiated by Neurons Lab for an APAC client, with plans for global scalability.

Task

The goal was to design and validate a 0→PoC version that met predefined OKRs — simplifying RM workflows for Q&A handling, portfolio analysis, and proposal generation, while enabling personalized client management through AI.

Action

The Neurons Lab team conducted stakeholder and RM interviews, identified core pain points, and translated them into key product features. Using the AI design platform v0.app, the team rapidly produced and iterated the PoC through multiple user testing rounds and refinements.

Result

The first iteration was completed in 19 hours, with the final validated PoC delivered in 90 hours, achieving an acceptance score of 4.5/5 and confirming its potential to transform RM productivity.

Arken is an AI co-pilot for a Bank Investment Department, designed to streamline the daily work of Relationship Managers (RMs) by consolidating internal data and external insights into one client-focused tool. The project was initiated by Neurons Lab for an APAC client, with plans for global scalability.

Task

The goal was to design and validate a 0→PoC version that met predefined OKRs — simplifying RM workflows for Q&A handling, portfolio analysis, and proposal generation, while enabling personalized client management through AI.

Action

The Neurons Lab team conducted stakeholder and RM interviews, identified core pain points, and translated them into key product features. Using the AI design platform v0.app, the team rapidly produced and iterated the PoC through multiple user testing rounds and refinements.

Result

The first iteration was completed in 19 hours, with the final validated PoC delivered in 90 hours, achieving an acceptance score of 4.5/5 and confirming its potential to transform RM productivity.

Overview

I joined Neurons Lab to help design AI co-pilots for investment banking teams.

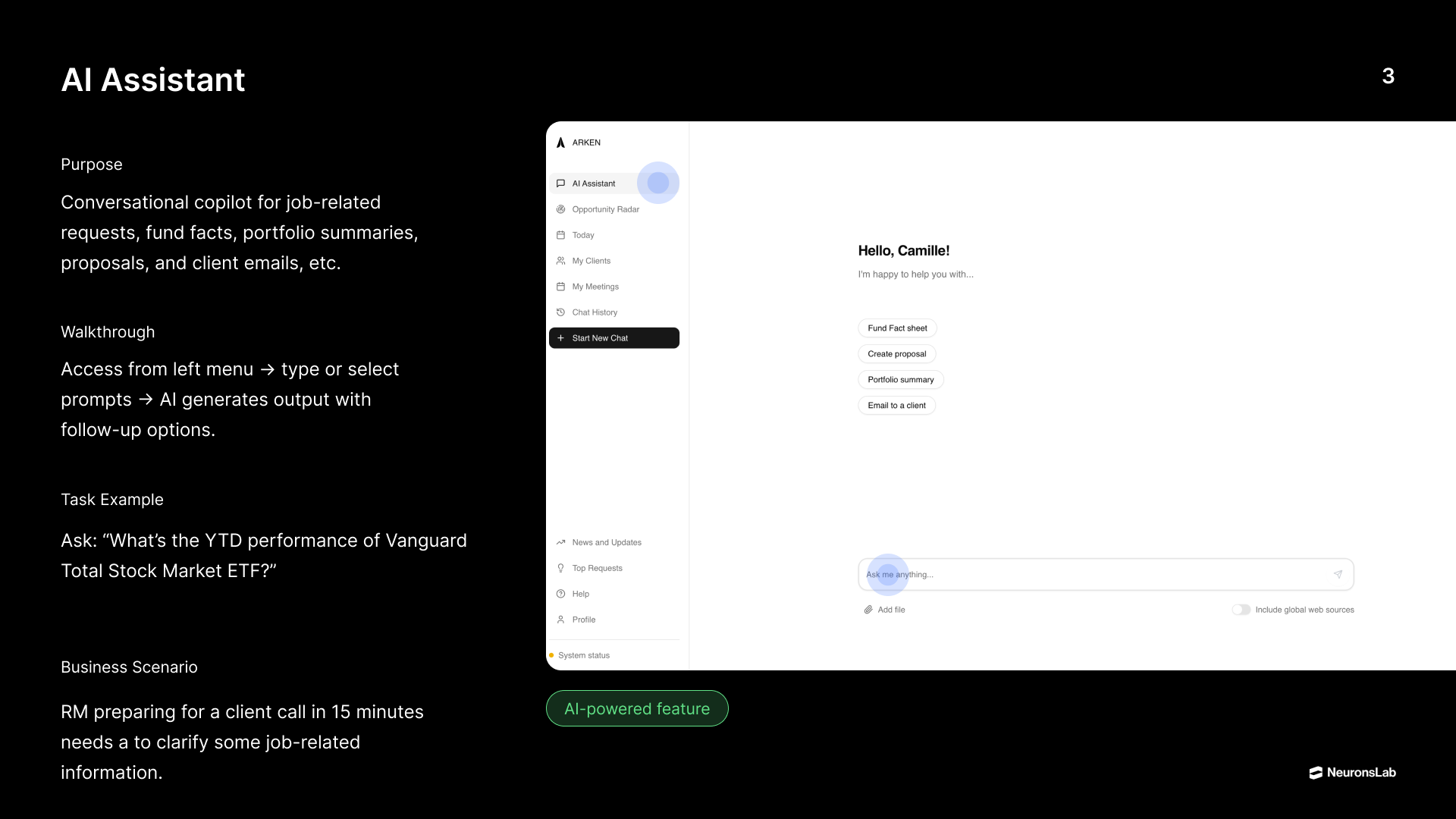

Our mission was to develop Arken, an AI assistant for the Investment Department of one of the leading APAC banks. The project already had clearly defined KPIs and strategic direction: create a co-pilot capable of supporting Relationship Managers (RMs) in their everyday work — collecting and analyzing data, generating investment proposals, preparing portfolio summaries, and managing client information.

During early discovery and user interviews, the scope expanded.

It became clear that Arken could not only assist with data but also help RMs personalize their client interactions, extract insights directly from conversations, and ultimately enhance their decision-making. The project was planned for eight weeks and required completing every stage of the product design process — from Discovery and Definition to Design and Delivery — while ensuring that the final prototype met the pre-established performance indicators.

Our mission was to develop Arken, an AI assistant for the Investment Department of one of the leading APAC banks. The project already had clearly defined KPIs and strategic direction: create a co-pilot capable of supporting Relationship Managers (RMs) in their everyday work — collecting and analyzing data, generating investment proposals, preparing portfolio summaries, and managing client information.

During early discovery and user interviews, the scope expanded.

It became clear that Arken could not only assist with data but also help RMs personalize their client interactions, extract insights directly from conversations, and ultimately enhance their decision-making. The project was planned for eight weeks and required completing every stage of the product design process — from Discovery and Definition to Design and Delivery — while ensuring that the final prototype met the pre-established performance indicators.

Discover

The discovery phase began with onboarding and a series of stakeholder interviews — both with the Neurons Lab team and the client’s leadership.

I needed to understand how the existing RM workflows operated, what the client expected from an AI solution, and which pain points were most critical.

I reviewed previous UX research, interview transcripts, and operational documentation. Then I conducted several additional stakeholder and RM interviews to refine insights.

These revealed a common pattern across all Relationship Managers:

These insights became the backbone of the problem statement and the foundation for the future design. I synthesized all information into user personas, representing both experienced and junior RMs. In parallel, I conducted benchmarking of comparable solutions including Jump, Magnifi, and Betterment to analyze how other financial platforms handled AI-driven workflows and personalized insights.

I needed to understand how the existing RM workflows operated, what the client expected from an AI solution, and which pain points were most critical.

I reviewed previous UX research, interview transcripts, and operational documentation. Then I conducted several additional stakeholder and RM interviews to refine insights.

These revealed a common pattern across all Relationship Managers:

- 70% of their time was spent on administrative and analytical work.

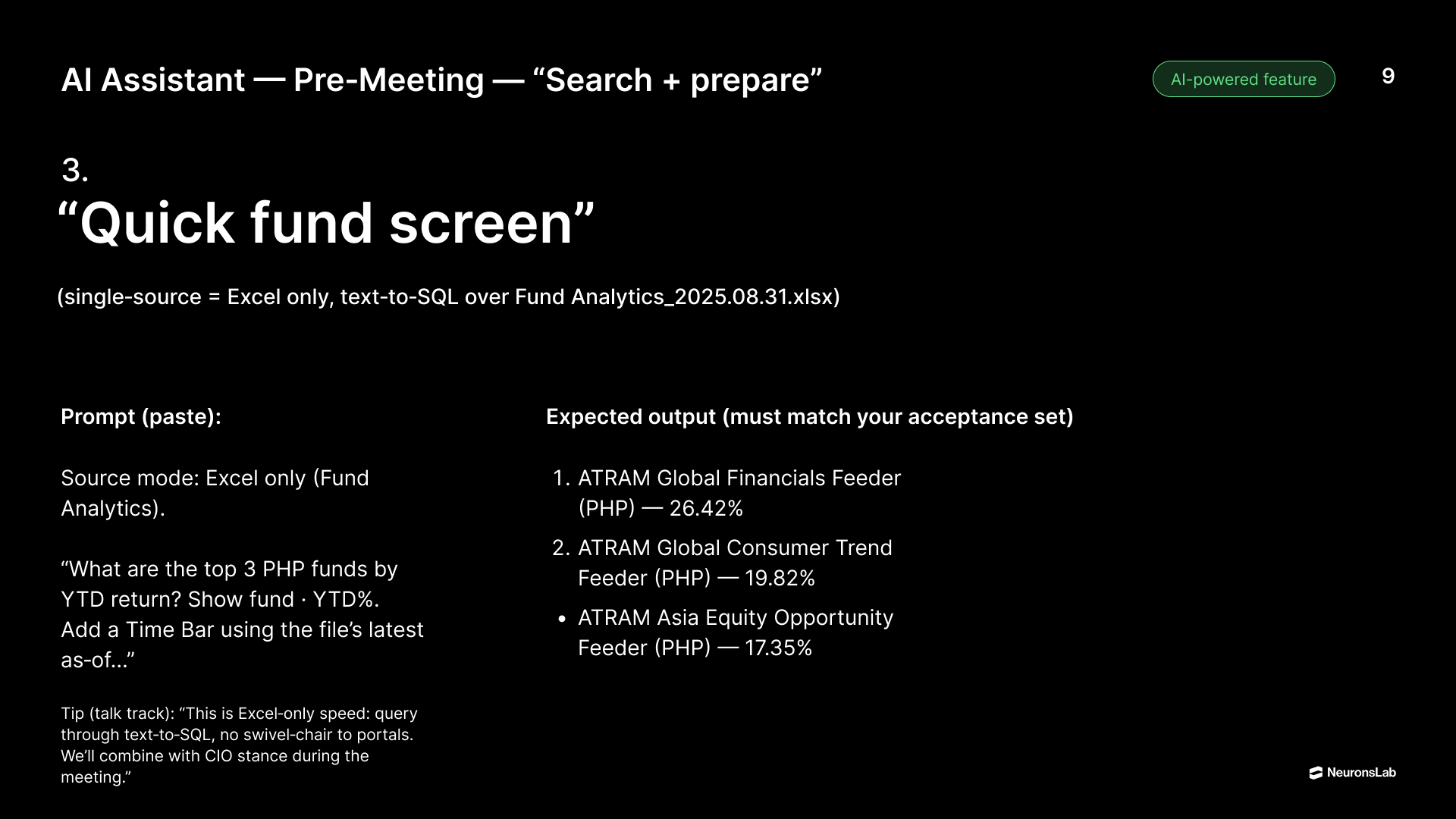

- Data was scattered across disconnected systems — Avaloq, SharePoint, Excel attachments, and Bloomberg terminals.

- There was no unified tool for creating proposals or accessing up-to-date client insights.

- Reporting and portfolio preparation often required 1–3 hours per client.

These insights became the backbone of the problem statement and the foundation for the future design. I synthesized all information into user personas, representing both experienced and junior RMs. In parallel, I conducted benchmarking of comparable solutions including Jump, Magnifi, and Betterment to analyze how other financial platforms handled AI-driven workflows and personalized insights.

Define

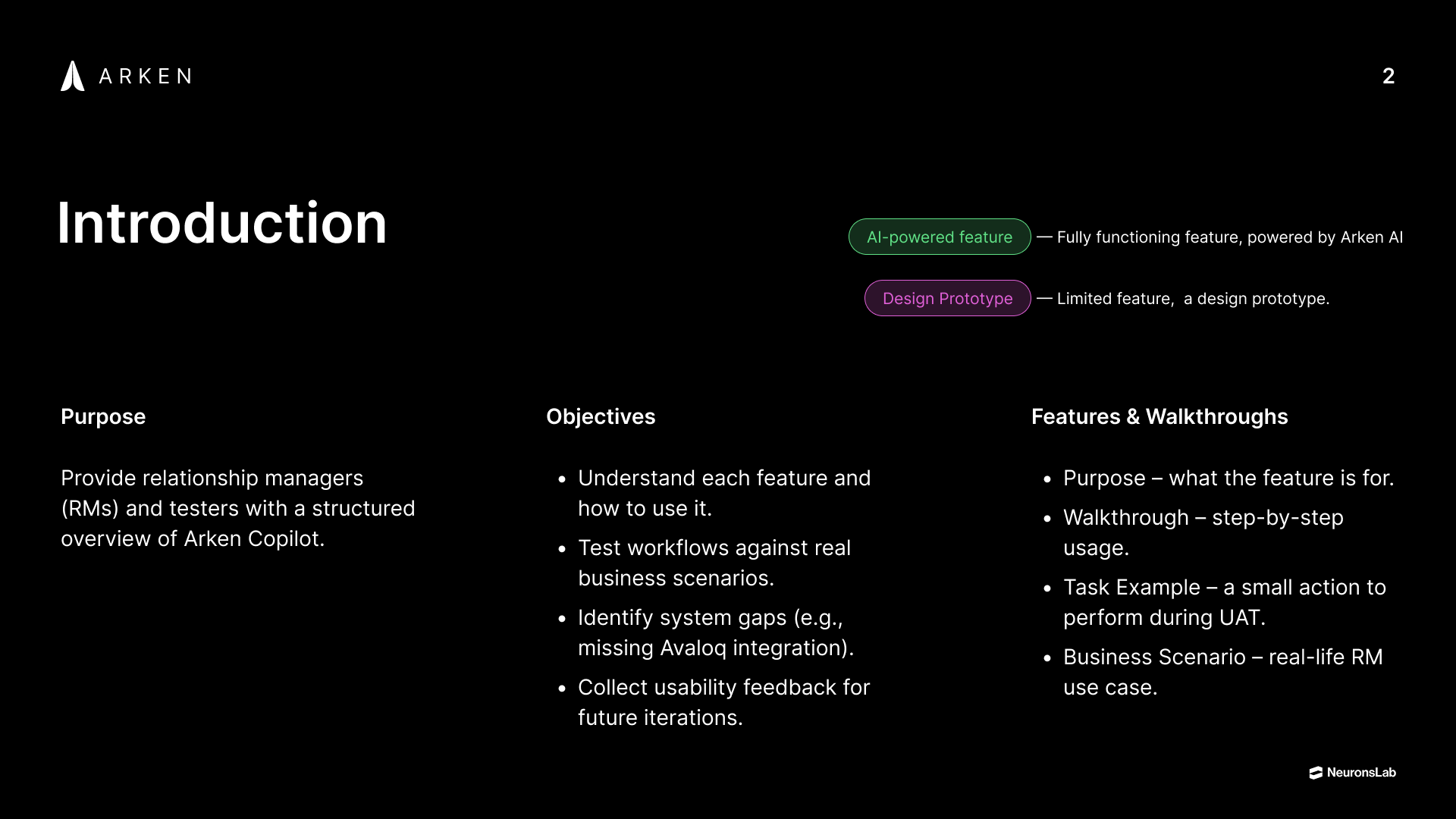

During the Define phase, I transformed research findings into clear product hypotheses and prioritized features. Together with the team, we created a hierarchy of functions that would bring the highest value in the proof-of-concept stage:

I also established feature acceptance criteria, ensuring that each could be tested and validated within the PoC timeline. By the end of this stage, we had a clear map connecting research insights to functional outcomes.

- Instant Market Copilot — to query CIO documents and generate data-driven answers.

- Proposal Co-Pilot — to help RMs create and personalize investment proposals faster.

- Client Context Builder — to keep track of client-specific insights and preferences.

- Opportunity Radar — to highlight relevant opportunities and market movements.

I also established feature acceptance criteria, ensuring that each could be tested and validated within the PoC timeline. By the end of this stage, we had a clear map connecting research insights to functional outcomes.

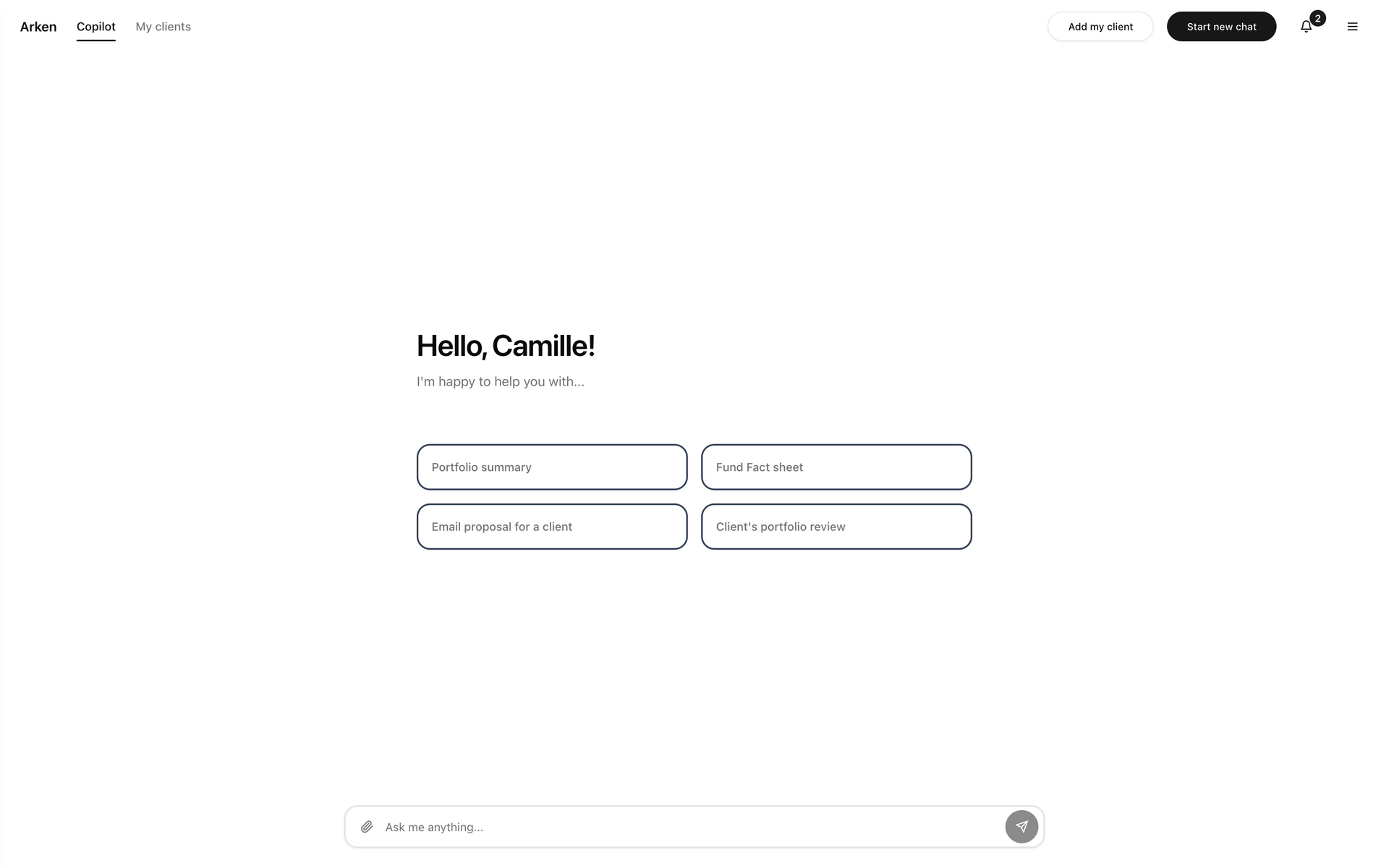

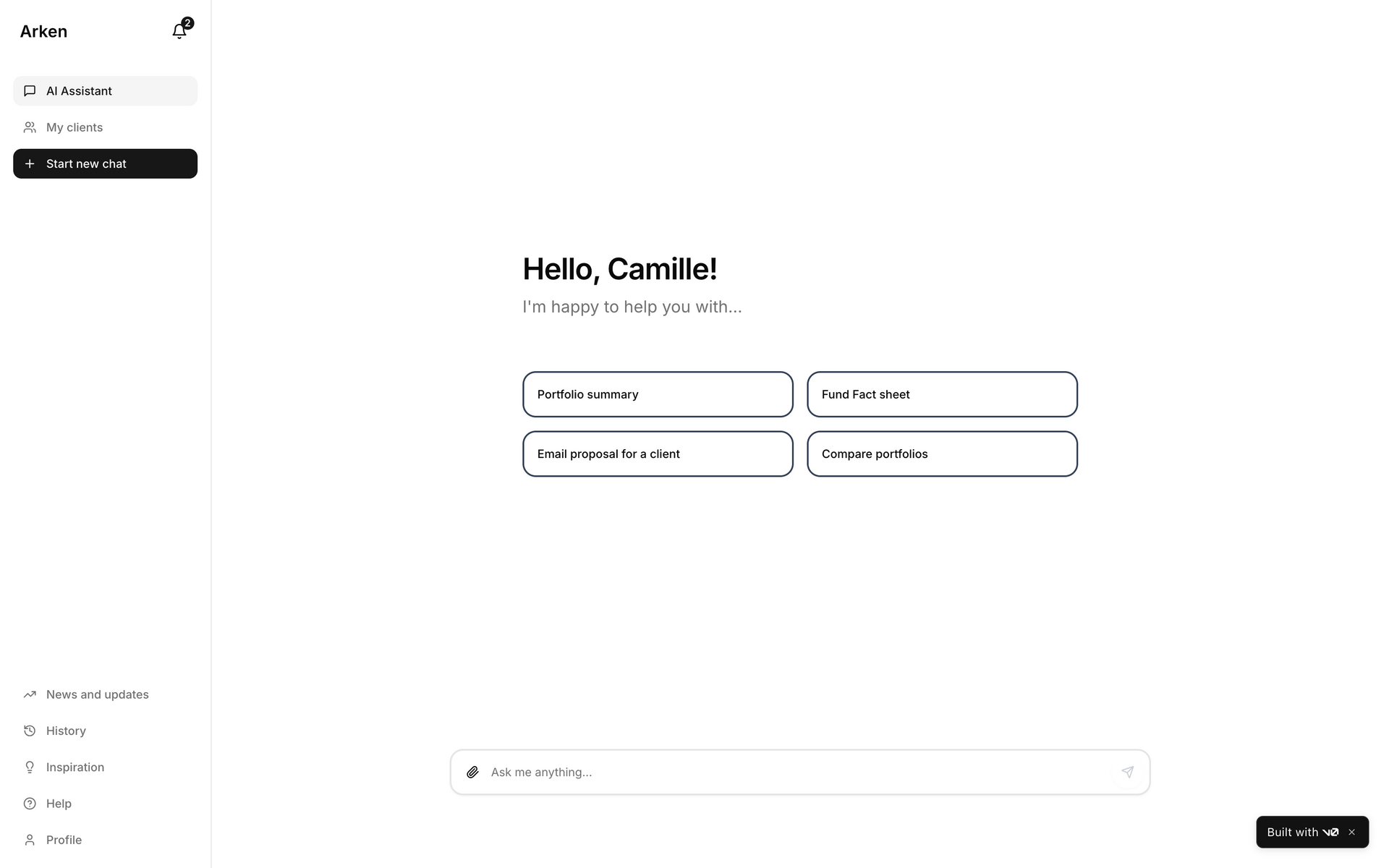

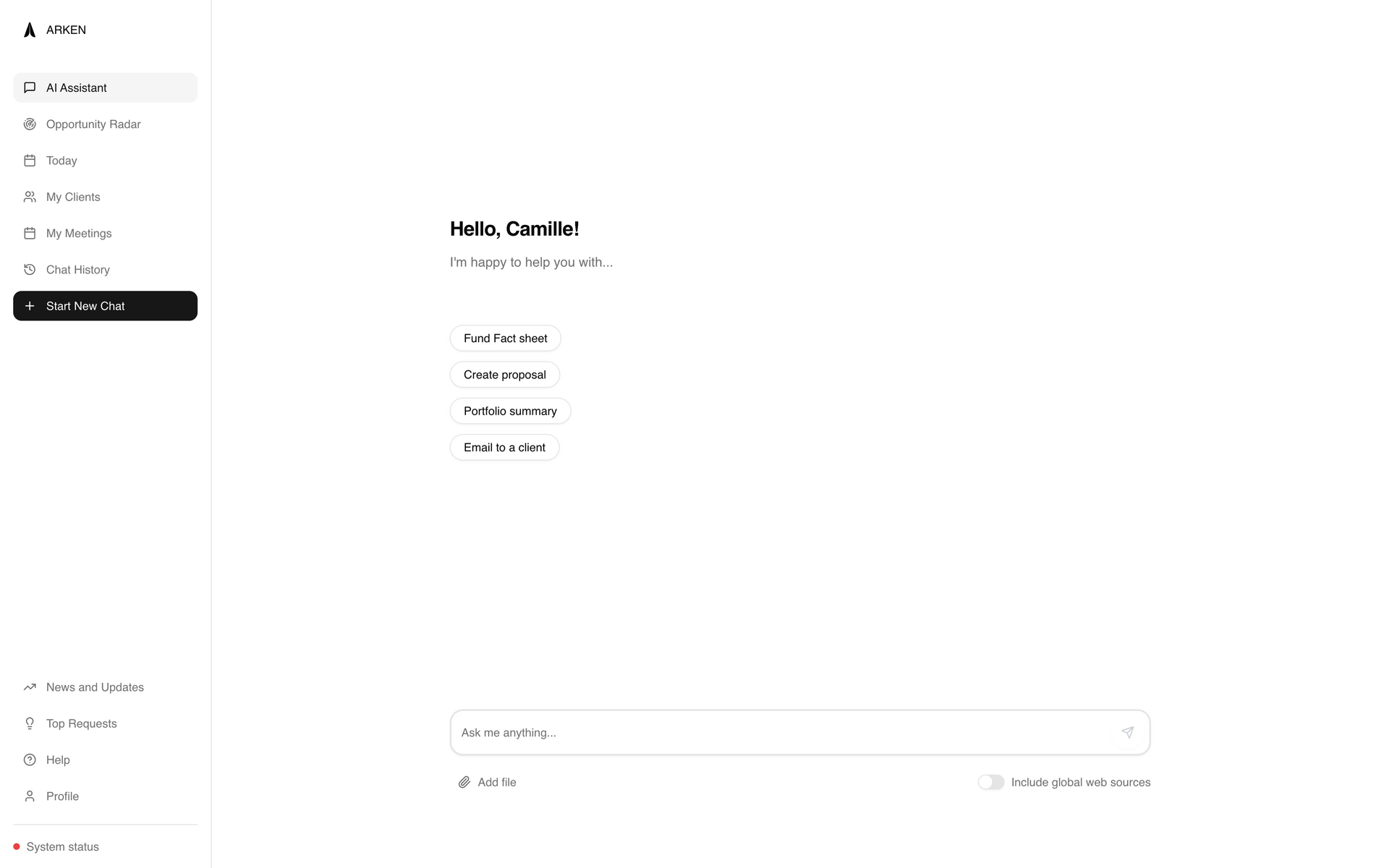

Design

The challenge at this stage was time. We had less than two months to deliver a complex, interactive prototype that looked and behaved like a real product — ready for testing with actual Relationship Managers.

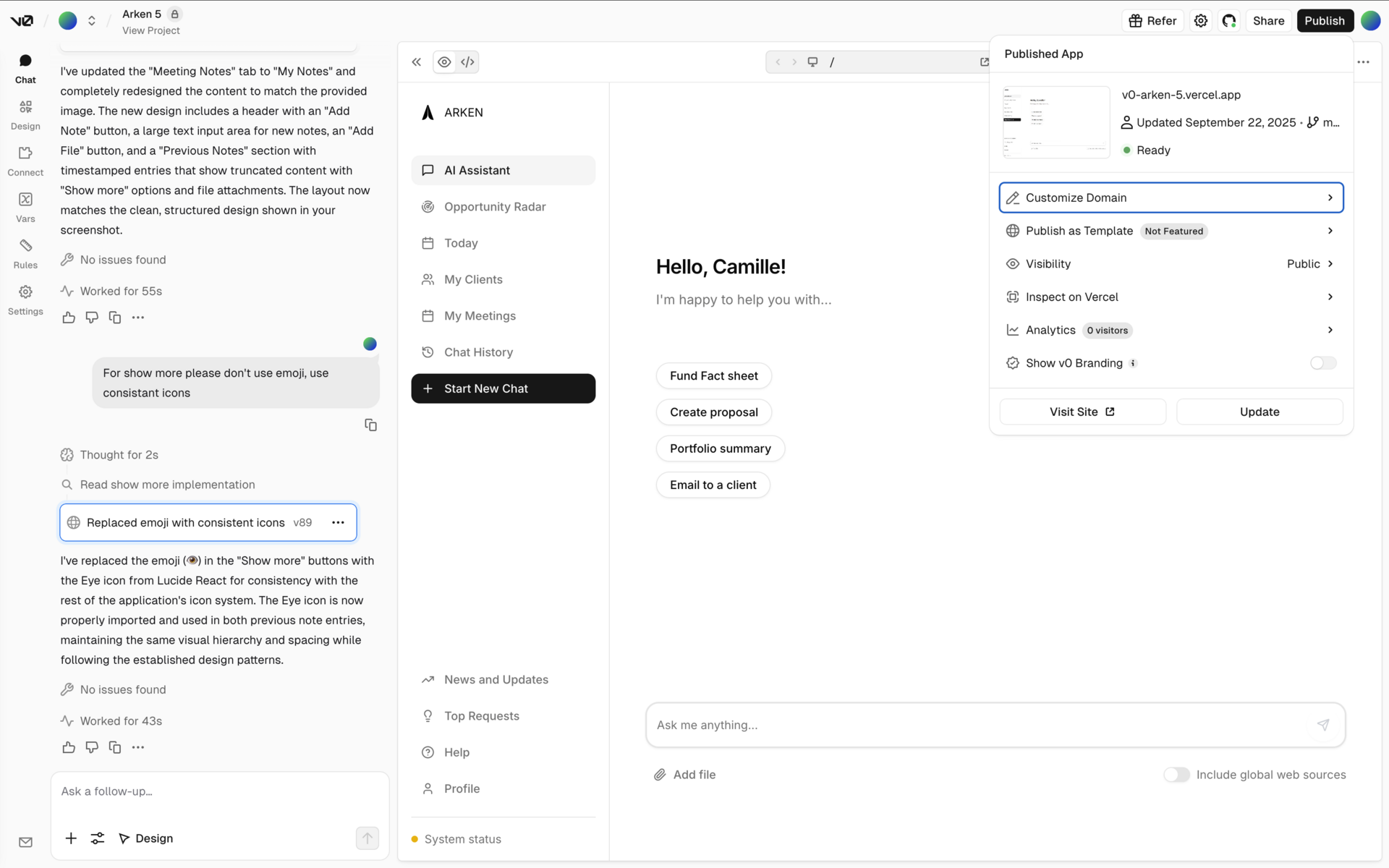

Given the distributed, cross-functional setup and tight schedule, I decided to integrate AI design tooling into my workflow. Instead of starting with blank artboards, I used v0.app to quickly translate insights into high-fidelity layouts and interactive prototypes.

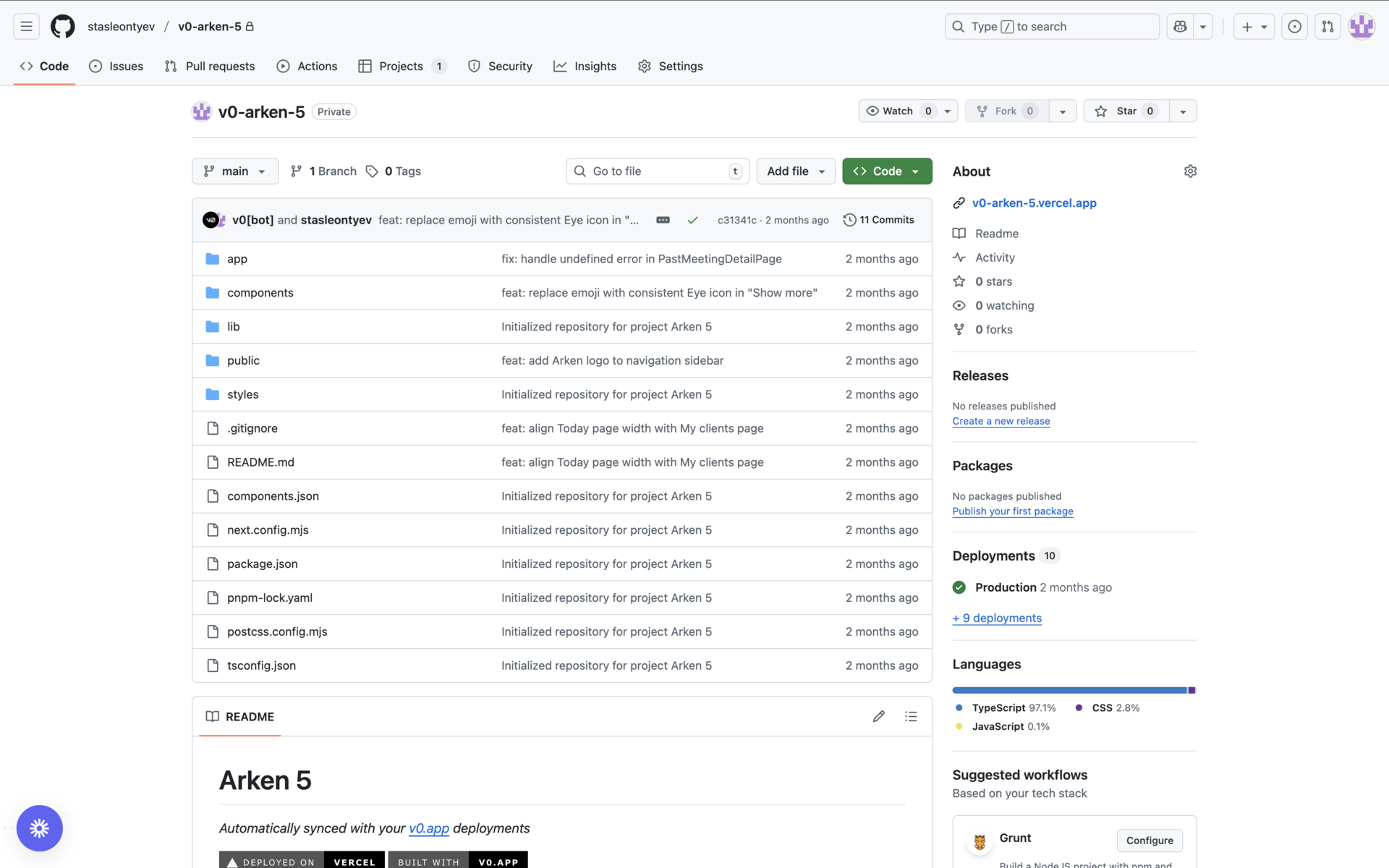

Working closely with our full-stack LLM engineer and a junior front-end developer, we synchronized design and development pipelines through VHC and GitHub. Each component created in v0 was immediately exportable and usable in code, accelerating delivery and minimizing translation errors between design and implementation.

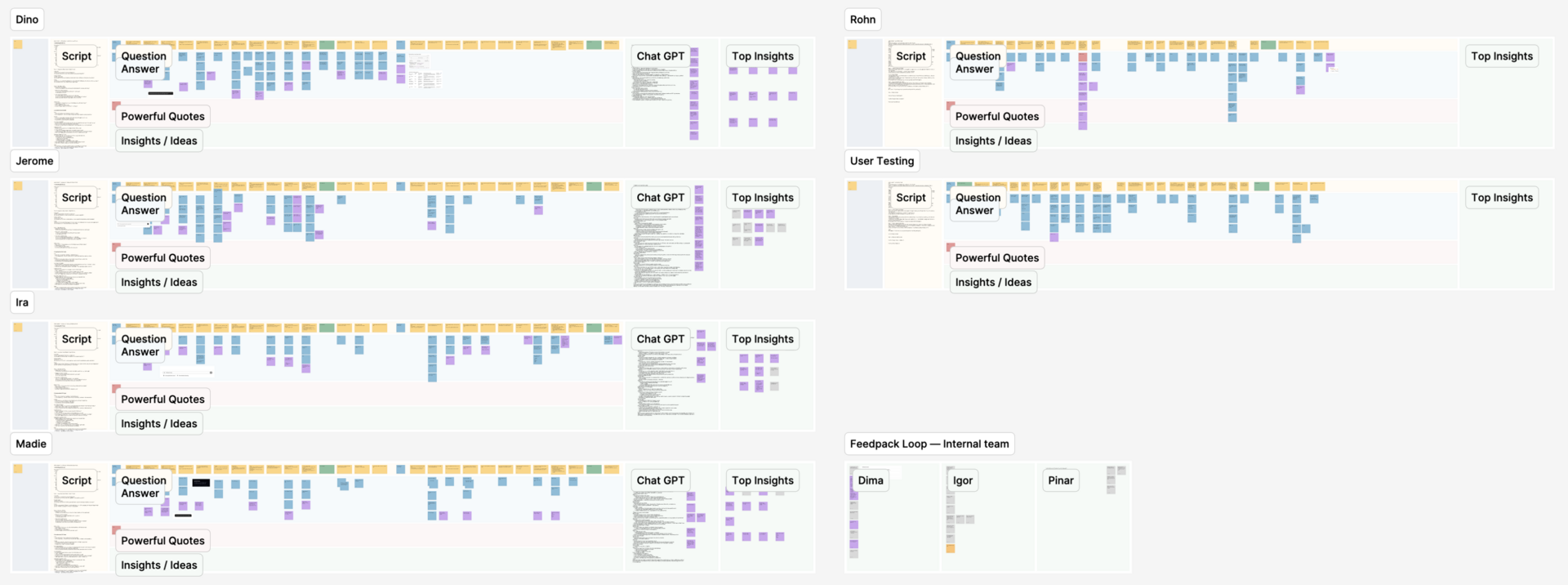

Every iteration was tested through user testing sessions — where RMs performed realistic tasks: searching data, preparing a client proposal, and reviewing portfolio insights. Feedback was immediate, and improvements were implemented in subsequent iterations.

Given the distributed, cross-functional setup and tight schedule, I decided to integrate AI design tooling into my workflow. Instead of starting with blank artboards, I used v0.app to quickly translate insights into high-fidelity layouts and interactive prototypes.

Working closely with our full-stack LLM engineer and a junior front-end developer, we synchronized design and development pipelines through VHC and GitHub. Each component created in v0 was immediately exportable and usable in code, accelerating delivery and minimizing translation errors between design and implementation.

Every iteration was tested through user testing sessions — where RMs performed realistic tasks: searching data, preparing a client proposal, and reviewing portfolio insights. Feedback was immediate, and improvements were implemented in subsequent iterations.

AI-Tooling

This project was not only about building an AI product — it was also about using AI to build AI. The design and development workflow itself was supported by v0.app, which helped generate interface patterns, refine user flows, and even create documentation drafts.

This synergy made it possible to compress what would traditionally take several weeks into less than 90 hours of focused design and iteration.

- v0 handled the initial visual generation and layout creation.

- LLM models supported early copywriting and user prompt testing.

- Integration with GitHub and EasyRocket automated design hand-offs into live code.

This synergy made it possible to compress what would traditionally take several weeks into less than 90 hours of focused design and iteration.

Identity

While the core focus was functionality, I also developed a simple and memorable visual identity for Arken. The logo — a stylized letter A — symbolized both Archimedes (as in the name Arken) and a mountain peak, representing growth and strategic perspective.

When inverted, the symbol forms a star, referencing AI brilliance and guidance.

The identity system was intentionally minimal, geometric, and white-label ready, making it easy to adapt to future banking clients or other AI co-pilot products developed by Neurons Lab.

When inverted, the symbol forms a star, referencing AI brilliance and guidance.

The identity system was intentionally minimal, geometric, and white-label ready, making it easy to adapt to future banking clients or other AI co-pilot products developed by Neurons Lab.

Deliver

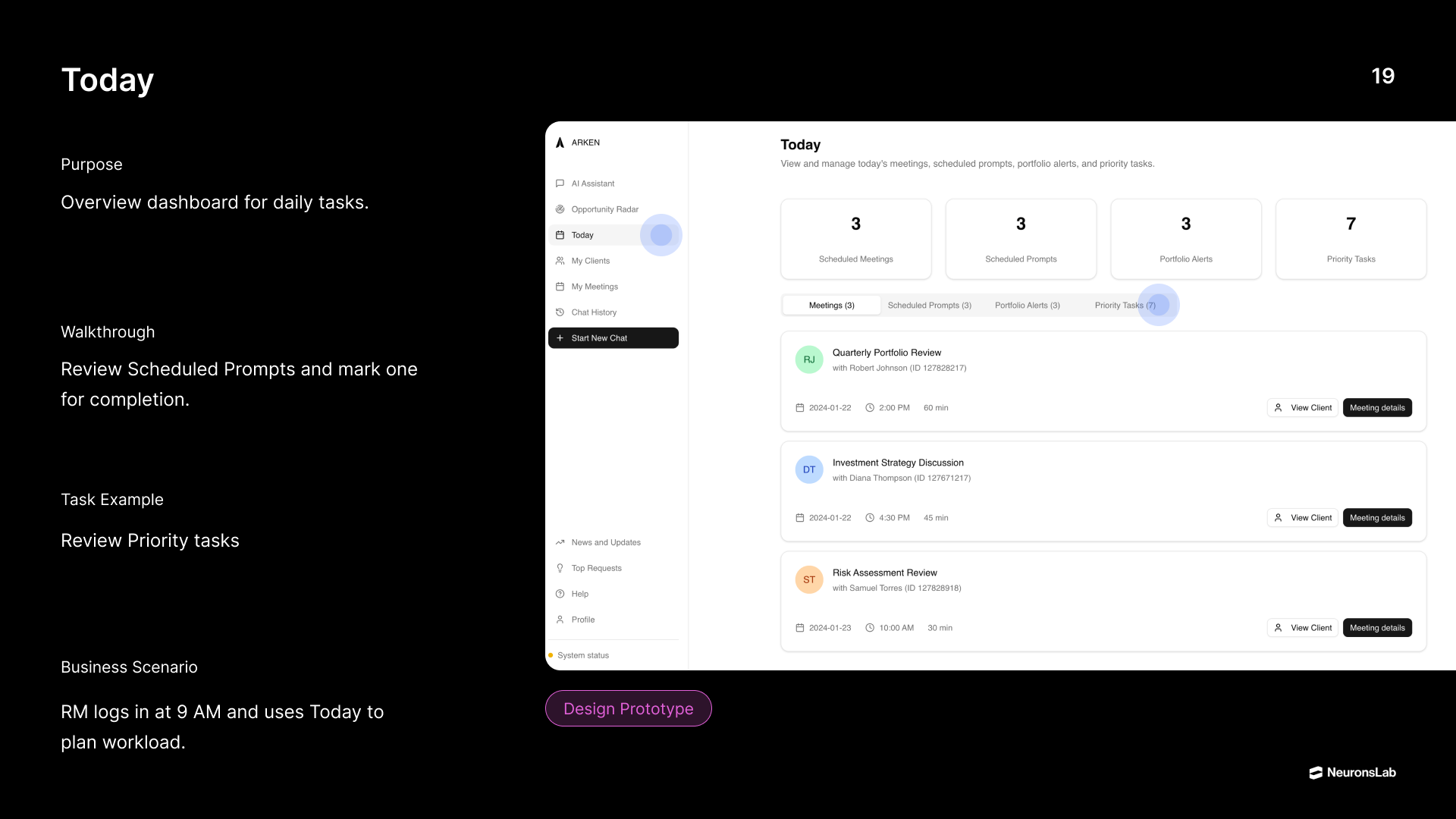

The Deliver phase connected all pieces — design, prototype, and validation. We established a continuous sync between v0 design files and the GitHub repository. This allowed us to test live prototypes almost instantly and to iterate within the same day.

Delivery included:

This setup helped the team evaluate feature adoption and measure satisfaction quantitatively.

Delivery included:

- Fully interactive prototype with real user flows.

- Internal testing documentation and feature validation checklist.

- A User Manual for onboarding RMs into the Arken environment.

- A Self-Assessment Form for collecting post-UAT feedback.

This setup helped the team evaluate feature adoption and measure satisfaction quantitatively.

Results and Impact

- 19 hours — initial discovery, definition, and prototype setup.

- 90 hours — final PoC delivery with two full validation rounds.

- 4.5 / 5 acceptance score from Relationship Managers.

- Achieved projected 35% productivity increase in RM routine tasks.

- Successfully validated AI-assisted proposal and portfolio workflows.

- Product designed for global scalability across other banking clients.

The client expressed strong interest in continuing the collaboration to develop a full-scale product, with rollout planned for Q1 2026.

Findings and Learnings

For me, Arken was an opportunity to see how AI integrates into agile design pipelines — both as a tool and as a subject of design. One AI system (v0) helped me build another (Arken).

This experience reaffirmed that AI can enhance human creativity and problem-solving rather than replace it. Collaboration with Neurons Lab was outstanding — a genuinely multidisciplinary team that shared a vision of innovation and precision.

The final design not only met KPIs but also anticipated future scalability: Arken was built as a customizable, modular AI assistant — adaptable to any financial institution, capable of learning, evolving, and expanding to new business cases.

This experience reaffirmed that AI can enhance human creativity and problem-solving rather than replace it. Collaboration with Neurons Lab was outstanding — a genuinely multidisciplinary team that shared a vision of innovation and precision.

The final design not only met KPIs but also anticipated future scalability: Arken was built as a customizable, modular AI assistant — adaptable to any financial institution, capable of learning, evolving, and expanding to new business cases.